Business Energy Prices – Are they still rising and why?

Every home and business knows that energy prices have risen over the past five years since the global pandemic, with the highest increases occurring in 2021 and 2022. Prices dipped in 2023, but 2024 saw steady energy rate rises. During 2025, prices have been relatively stable, with seasonal increases expected in winter. However, energy prices remain high compared to the post-price-hike levels in 2022.

Why have UK energy prices risen?

To understand why prices have risen over the past five years, it’s important to look back at recent events, internal conditions and global factors that influenced energy prices.

Recent Events

2020

- During the lockdown in early 2020, reduced demand caused energy prices to remain low.

- As demand recovered, gas and electricity rates exceeded pre-pandemic levels, while rising policy and regulatory costs, like the Renewable Obligation (RO) levy and network charges, further drove up prices.

2021-2022

- Between August 2021 and August 2022, wholesale prices surged over 500% due to:

- Lockdowns easing and increase demand for energy as businesses and events reopen.

- Global events, including the Ukraine conflict and the closure of Nord Stream and other infrastructure issues

- Over 40% of European gas imports were from Russia in 2021, and the conflict threatens this supply, driving prices up

- Despite the UK only using 5% imports from Russian gas, the wider supply crisis across Europe required the UK to change its gas balancing policy to reduce future risks.

- Extended cold periods increased worldwide gas demand, depleting supplies more rapidly and contributing to higher prices.

- 34 UK energy suppliers went out of business due to being unable to handle the rising wholesale energy prices, which drove up prices even further.

- Prices reached a record high decoupling from market fundamentals

- Countries like China and Japan have increased liquefied natural gas (LNG) imports to reduce coal reliance, limiting the UK’s access to LNG and affecting gas prices.

2023

- Prices then began to fall because Europe shifted from Russian gas to more LNG imports from other suppliers.

- A mild winter across the UK and Europe, and energy-saving efforts being made by homes and businesses because of the fear of high energy bills, helped to reduce demand and resulted in a drop in price.

- A fire on the national grid infrastructure in Kent disrupted a major power line from France, curtailing electricity imports until 2023.

2024-2025

- 2024 became the year of market correction, as a new stable market price was established at £80/mwh

- Ongoing conflict in the Middle East created uncertainty in global oil and gas markets. Disruptions to shipping routes, especially in the Red Sea, increased transport costs for LNG and oil, which fed into UK wholesale prices.

- Political uncertainty following the 2024 US election, including concerns over potential changes to US LNG export policy, influenced market confidence.

- Stronger global demand for LNG, particularly from Asia, reduced the availability of flexible cargoes for Europe, pushing up gas prices at certain points.

Internal Conditions

Low Gas reserves

The UK cannot stockpile any excess gas for when it may be needed due to limited storage options. In fact, the UK has some of the lowest gas reserves in Europe as its capacity of reserves are around 2% of annual gas demand. The average reserves of European countries are 25% and 37% for the largest reserves.

Reduced Renewable Output

Low wind activity and nuclear outages result in less renewable energy being generated. This results in a higher amount of gas being used to generate electricity, which increases costs. Even green tariffs increase in price because renewable energy prices are linked to the price of gas.

Limited Financial Support

Previous financial support for business from the Government has ended, and a price cap system does not exist at present. Whereas in comparison to other European countries, France for example, capped electricity price increased to 4%.

No Energy Price Cap for Businesses

Unlike households with a price cap, UK businesses lack this protection. Recent government support included discount schemes like the Energy Bills Discount Scheme, which ended on March 31, 2024. Future support is still uncertain, and businesses should stay informed about potential government policy changes that could impact energy prices.

As there is no price cap on business energy, energy rates vary with wholesale market conditions, which can be volatile and difficult to predict. The domestic cap does provide a signal for the business market and can be used to predict business prices.

Non-Commodity costs

Including network charges and policy-related costs, overall electricity rates continued to increase even as wholesale prices stabilised.

Global Factors

Oil prices

Oil prices aren’t as influential to the UK’s energy generation as they are to other countries, but they still have a knock-on effect. Due to OPEC production cuts or conflicts in the Middle East, oil prices rise. Transport and supply chain costs increase as well, where gas prices are linked to oil; both costs will rise together.

Global gas prices

The UK is a large importer of gas, especially LNG from the US, Qatar and Norway. When these supplies are disrupted by wars, sanctions or extreme weather, prices will increase due to less supply. As gas powers electricity generation, higher gas prices have a knock-on effect of higher electricity prices.

Forex Exchange Rates

The forex and currency exchange rates influence energy prices because energy is priced globally in US dollars. Whenever there are changes to either the strength of the US dollar or the UK pound, it will cost more or perhaps be cheaper to import gas and oil.

Extreme Weather

Severe weather and disasters can damage energy-generating sites or infrastructure to transfer energy, once again affecting supply. Abnormal weather conditions can increase demand, so a prolonged cold spell would use up UK gas reserves and therefore force prices to increase.

Are energy prices still rising?

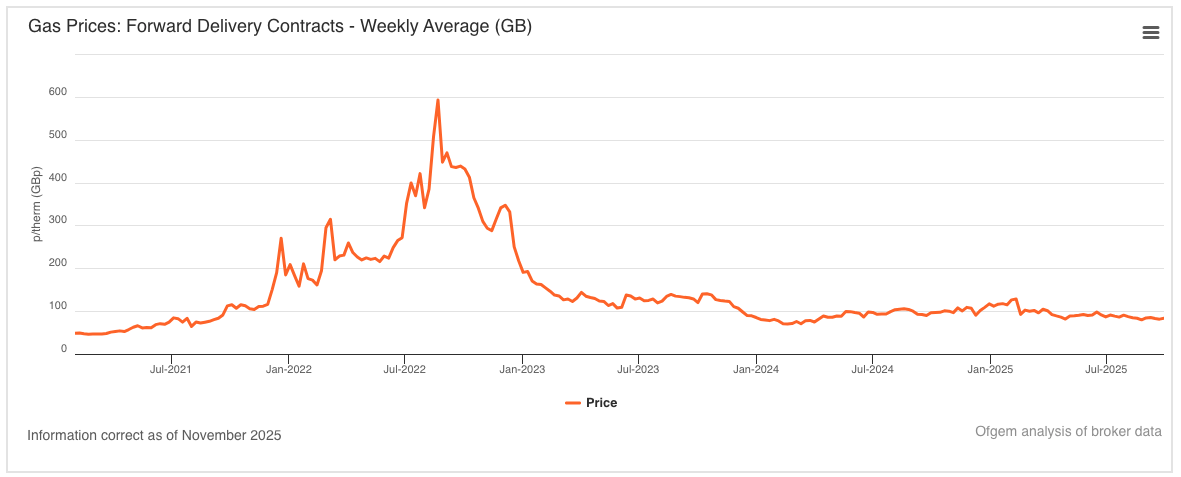

Yes, but despite the current market conditions on wholesale rates being relatively stable, and appearing to be at a similar level before the high volatility experienced in 2022 (figure 1, figure 2), the overall energy prices are still higher than average. This is because other factors make up your energy bill; it’s these non-commodity costs that are currently driving up prices.

Should I fix my business energy contract?

Yes and no. Currently, prices are much higher than before the 2022 price spike, and without a cap on business energy, it means prices could rise without any government intervention. Therefore, it could be worthwhile agreeing to a fixed-price energy contract to lock into a more favourable rate in case of any further price increases, especially as it is not expected that prices will drop to pre-pandemic levels again. Fixing can also provide stability in a volatile market and help with financial predictability at a time when long-term prices are still projected to remain high. In addition, you avoid being placed on a supplier out-of-contract rate, which can be as much as 35% higher than fixed contracts.

However, you have to consider your attitude to risk. Once fixed in, business contracts are traditionally at least two years in length, and you never know if there could be a drop in price. With fluctuations in 2025 levelling out, fixing may be a strategic option for some businesses, but the decision ultimately depends on whether you value certainty or flexibility.

Will energy prices go back to pre-pandemic levels?

Despite the wholesale prices having fallen, the price of energy is still high, and it’s predicted that it won’t return to pre-pandemic levels this decade. This is because wholesale price drops are not passed on to the customers due to several factors:

- Energy suppliers buy energy in advance to offer fixed rates. If they previously bought energy at higher prices, they can’t immediately lower what customers pay just because today’s wholesale price has dropped.

- Suppliers build risk into their pricing, much like lenders do with interest rates. This protects them from sudden market changes and unexpected costs.

- Suppliers constantly buy energy to meet demand. If demand suddenly rises, they may need to buy more energy at current (potentially higher) prices. If demand falls and they have excess energy, they must sell it back to the grid—sometimes at a loss if the market price is lower than what they originally paid.

- In a volatile market, suppliers face higher financial risk, so prices stay higher for longer. Only when wholesale prices stay lower for a consistent period do those reductions typically make their way to customers.

Current wholesale energy prices

The latest Ofgem and ICIS figures provide a snapshot of wholesale costs affecting business energy rates:

- Gas is around 80p per therm (approximately 29 kWh). [3.6p per KWh].

- Electricity averages £75 per MWh (1,000 kWh). [8.9p per KWh].

Day-ahead contract rates, adjusting daily based on live demand, also play a role:

- Gas is priced at roughly 79p per therm. [2.9p per KWh].

- Electricity costs about £71 per MWh.

Why are energy prices volatile?

Energy prices respond to market supply and demand, which causes their price to fluctuate. Low supply raises prices; high supply reduces them. Increased demand pushes rates up, while lower demand brings them down. Market confidence also plays a part, as traders react quickly to news about potential shortages or political risks, which can cause prices to jump even before any real disruption occurs.

Supply chain issues can also increase volatility. Less supply will result in higher prices, and supply can be influenced by many of the factors already mentioned, including pandemics, shipping delays, global crises and weather events. Even rumours of disruption can push prices up, as uncertainty in international energy markets is often priced in immediately. This behaviour filters through to the UK’s wholesale market and contributes to sudden price movements for businesses.

How do energy suppliers handle price volatility?

To manage risk, suppliers often use futures markets to lock in fixed prices for future energy needs. This means they buy or sell a set amount of energy at an agreed price and then settle the contract at a future date. In periods of extreme unpredictability, such as the 2022 price spike, this approach became far more difficult, and some suppliers temporarily withdrew from providing prices due to the heightened risks of short supply.

Why are electricity prices higher than gas prices?

UK electricity prices are also closely tied to gas costs because a significant proportion of electricity is generated from gas-fired power stations. When gas prices increase, electricity costs typically rise as well, making volatility more challenging for businesses to plan around.

This volatility affects gas and electricity differently, and there are several reasons why electricity prices tend to be higher than gas prices:

- Electricity generation is more complex. Producing electricity requires extensive infrastructure, multiple conversion processes and ongoing operational management, all of which make it more expensive to generate and distribute compared to gas. Gas extraction and distribution are more straightforward, leading to lower overall costs.

- Environmental and policy levies increase costs. Electricity bills often include additional charges to support renewable energy, carbon reduction schemes and wider environmental policies. These levies are applied far less frequently to gas, creating a natural price difference between the two.

- Greater investment in the electrical grid. Maintaining and upgrading the electricity network requires significant long-term investment. These costs are passed through to consumers. In contrast, gas infrastructure tends to require less frequent and less costly upgrades, helping keep gas prices comparatively lower.

Why are renewable energy prices also rising?

Even on 100% renewable energy plans, prices have surged. This stems from the UK’s marginal cost pricing model, where the costliest energy source sets the price for all, meaning gas-fired power often influences renewable rates, irrespective of the lower operational costs associated with renewables. The government is considering a shift to a Contracts for Difference (CfD) approach. Under CfD, renewable and nuclear producers receive a fixed price, uncoupling a high percentage of renewables in the UK’s energy mix from gas costs, which could stabilise prices for those opting for clean energy.

Options if you cannot afford your energy bills

If your business is struggling to cover energy costs, promptly contacting your supplier to discuss a payment plan is essential. Without an agreed plan, suppliers may initiate disconnection procedures after 30 days of missed payments. Seeking guidance early can help prevent service interruptions and provide alternative options for managing arrears. It’s also important to look at ways to reduce your consumption through an energy audit; once you understand your usage, you are in a better position to find energy deals that may help you save. In addition, make sure you know when your contract renewal date is so that you can potentially look for a more competitive deal before being locked into an auto-renewed contract.

Choose the right energy contract

At Professional Energy Services, we help businesses select the best energy contracts based on their consumption, forecast and attitude to risk. Our business energy consultants have helped countless businesses save thousands on their energy costs by working alongside our clients and helping them to navigate the complex and volatile energy market. Speak to a member of our team and see how you could start saving today.