Energy Market Intelligence

Ensure you have the latest and more accurate intelligence on the volatile global energy market to make the best decisions for your energy management strategy.

The energy market is every changing and highly volatile, wholesale prices can swing drastically within a day, let alone a week, new energy legalisation must be followed or penalties can occur, carbon cost come with uncertainly as policies shift, and finally fluctuating non-commodity charges on your energy bill can increase your costs. This brings multiple challenges for business owners and general managers who are trying to protect their margins while also hitting net-zero targets. With Energy Market Intelligence, Professional Energy Services (PES) can help you navigate this ever-changing environment.

Energy Market Intelligence Services

At Professional Energy Services (PES), we create daily and weekly market intelligence reports that provide you with comprehensive insights into the volatile global energy market.

Our market intelligence empowers businesses to make strategic decisions on their energy that are educated and well informed. We combine the latest market developments and trends, real‑time tracking of energy prices, and geopolitical events to analyse the latest market dynamics into clear, actionable guidance. Using our reports, your business can anticipate change, secure more advantageous energy contracts and manage risk with confidence, providing you with the insights for effective energy management.

Our Market Intelligence includes the following reports;

Daily Energy Market Reports

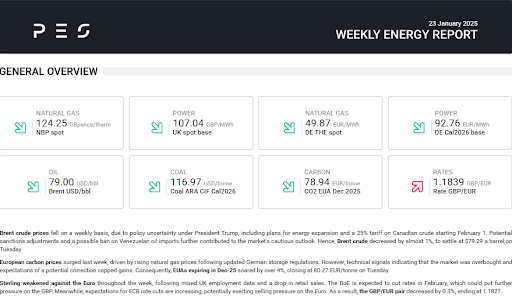

Market Snapshot

A concise overview of the day’s energy prices across key global markets, including oil, natural gas, coal, and electricity.

Highlights of significant price movements, trends, and percentage changes compared to previous days.

Fundamental Analysis

In-depth analyses of supply and demand dynamics, including inventory levels, production rates, and consumption patterns.

Discussion of factors influencing market behaviour, such as weather patterns, seasonal changes, and economic indicators.

Geopolitical Developments

Updates on geopolitical events, regulatory changes, or trade agreements that may impact global energy markets.

Insight into OPEC meetings, legislative developments, and international relations affecting energy supply chains.

Technical Analysis

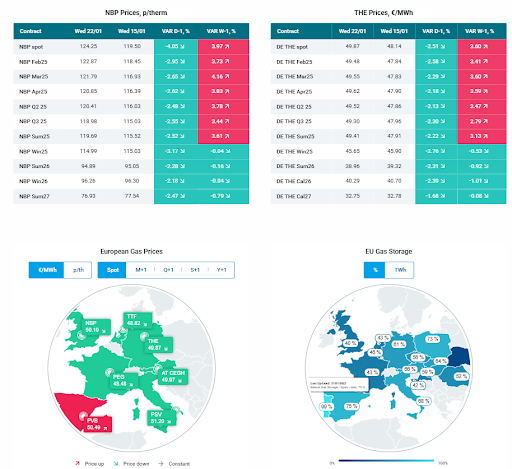

Charts and graphs that illustrate market trends and price movements, along with technical indicators signalling potential future price directions.

Emerging Issues

Identification of new trends or disruptions that could affect energy markets, such as technological advancements, shifts towards renewable energy, or changes in consumer behaviour.

Weekly Energy Market Reports

Comprehensive Market Review

A detailed review of the week’s developments, summarizing critical events and their impacts on global energy prices and supply chains.

Comparative analysis of changes across different markets, offering a broader perspective.

Sector-Specific Insights

In-depth analysis of various energy sectors, such as renewables, fossil fuels, and electric markets, highlighting sector-specific trends and forecasts.

Evaluation of the impact of government policies and corporate strategies on different segments of the energy landscape.

Price Forecasting

Short and medium-term price forecasts based on quantitative models and qualitative assessments, utilizing data from the daily reports and additional market intelligence.

Scenarios that illustrate potential market conditions, accounting for various influencing factors.

Global Demand and Supply Review

Overview of global energy consumption patterns and production levels, detailing trends in major consumer countries and producers.

Analysis of macroeconomic indicators that influence energy demand, such as GDP growth rates, industrial activity, and population trends.

Client-Specific Implications

Tailored insights and recommendations for clients based on the findings, helping them understand how marketplace shifts might affect their operations and strategies.

Renewable Energy Market Intelligence

Decarbonise your energy without overpaying with our market intelligence.

Renewable PPAs, REGOs and offset certificates can lock you into premiums if the timing or contract structure is wrong. Our Renewable Energy Market Intelligence module tracks:

- PPA price indices for onshore wind, offshore wind and solar, updated daily

- Upcoming UK Contracts for Difference (CfD) auction timetables and clearing-price scenarios

- Asset-level generation forecasts correlated with satellite-verified weather data

- Emerging technologies (e.g., green hydrogen, long-duration storage) that could reset future price floors

By keeping on top of the ever-changing renewable scene, you can agree PPAs at fair value, build credible net-zero roadmaps and report progress with confidence.

Bill & Non-Commodity Charges

Our Market Intelligence helps you see every penny before it appears on your invoice. Network, balancing and policy levies already make up more than half of an average UK power bill, and they’re rising faster than wholesale energy. Our market intelligence brings insights to your energy bills by:

- Forecasting TNUoS, DUoS, BSUoS, RO, FiT, CfD and Capacity Market charges under multiple demand scenarios

- Highlights site-specific optimisation levers such as Triad-avoidance or load-shifting windows

Armed with this intelligence, your finance teams can provision budgets accurately and operations teams can implement targeted cost-avoidance measures. In addition, we can provide energy bill validation that reviews your current and previous invoices, and finds any overcharges that can be reconciled to earn you money back.

Find the best energy deal